Invoices can be a tricky thing – you want to get paid, but you don’t want to seem overly aggressive. So how do you follow up on past-due invoices without sounding like a nag?

Here are a few tips:

1. Send a reminder email or letter. A simple, polite reminder that an invoice is a past due can often be enough to prompt payment.

2. Make a phone call. This can be a little more direct, but sometimes a personal touch is what’s needed to get the ball rolling.

3. Use online tools. There are now various online platforms that allow you to track payments and send automatic reminders when invoices are past due.

4. Hire a collections agency. If you’ve tried all of the above and still haven’t received payment, it may be time to hire a professional collections agency to help recoup your money.

How do you follow up on past due invoices – Reminders for payments?

If you’re like most businesses, you probably have a system for issuing invoices and tracking payments. But what happens when a customer doesn’t pay on time?

What exactly is a past-due invoice?

A past-due invoice is one that has not been paid by the due date specified in the invoice payment terms. Late payments put your company at risk; after all, you can’t pay your bills if your client doesn’t pay theirs. When dealing with past-due payments, it’s critical not to panic and to stay positive, even if it means working a little harder to collect.

Here are some reminders for following up on past-due payments:

1. Send a reminder email or letter as soon as the invoice is overdue.

2. Follow up with a phone call if you haven’t received payment after a week or two.

3. Be polite but firm in your reminders. Avoid sounding threatening or angry.

4. Offer alternatives to paying by checks, such as online bill pay or credit card payment.

5. If the customer still doesn’t pay, you may need to take legal action to get your money.

How to follow up on past payments professionally

It can be difficult to chase payments, but it’s important to follow up on past-due invoices in a professional manner. Here are some tips on how to do so:

1. Send a reminder email or letter. This is a polite way to remind the customer that payment is overdue. Be sure to include the original invoice and any relevant information, such as payment terms and deadlines.

2. Pick up the phone. Sometimes a friendly phone call can prompt a customer to make a payment. Be polite and firm, and avoid sounding threatening or angry.

3. Use social media. If you’re comfortable doing so, you can reach out to customers via social media platforms like Twitter or Facebook. Just be sure not to post anything publicly that could embarrass or antagonize the customer.

4. Hire a collections agency. If you’ve tried all of the above methods and still haven’t received payment, you may need to hire a collections agency to help recoup the debt. This should be seen as a last resort, as it can damage your relationship with the customer and negatively affect your business’s reputation.

Payment Reminder Email Templates

As a small business owner, you’re likely familiar with the importance of prompt payment from customers. Not only does timely payment help to ensure the financial health of your business, but it also shows respect for the products or services that you provide.

Unfortunately, there are always going to be customers who don’t make timely payments on their invoices. While it’s important to follow up with these customers and remind them of their outstanding balance, you don’t want to do so in a way that is overly aggressive or confrontational.

The following are some tips for writing payment reminder emails that will encourage your customers to pay their outstanding balance without damaging your relationship with them:

– Keep it polite: You should always start and end your email on a polite note, even if the customer is past due on their payments.

– Be clear about the amount owed: Customers should never have to guess how much they owe you. Be sure to include the total amount owed in your email so there’s no confusion.

– Give a deadline: Letting customers know that they need to pay by a certain date will motivate them to take action. Just be sure not to set the deadline too close to the date of your email, as this could backfire and result in even slower payments.

– Offer a discount: If you’re willing to offer a discount for early payment, be sure to mention this in your email. This can be a powerful motivator for customers

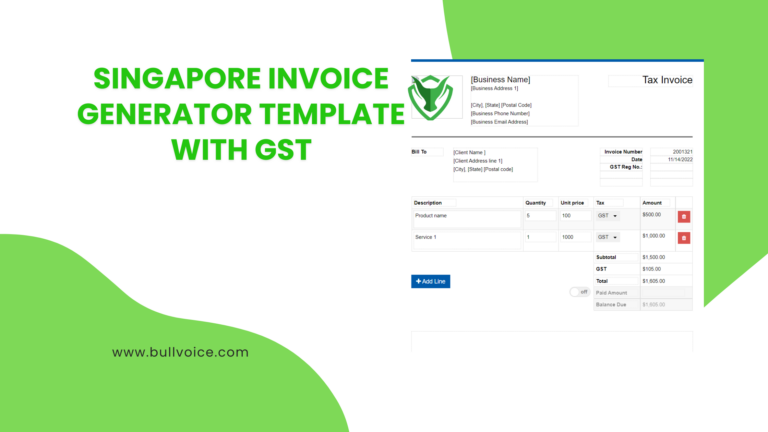

Also, we have a system to follow up on past-due invoices. Checkout Bullvoice.com

Start free

Start free